Facing Foreclosure? How to Submit a Loss Mitigation Request to Avoid Foreclosure

Introduction: Navigating Foreclosure with RESPA and Loss Mitigation

Facing foreclosure can feel overwhelming, but the Real Estate Settlement Procedures Act (RESPA) offers critical protections for homeowners. If you're wondering, "How do I submit a loss mitigation request to my mortgage lender?" or "What are my rights under RESPA?", this guide breaks down the process in a clear, actionable way. Whether you're seeking to save your home or understand your options, knowing how RESPA governs loss mitigation can make a big difference.

In this article, we’ll explain:

- What RESPA rules mean for homeowners.

- How to submit a loss mitigation application to your lender.

- Key timelines in the foreclosure process.

What Is RESPA and How Does It Protect Homeowners?

The Real Estate Settlement Procedures Act (RESPA) is a federal law that regulates mortgage servicers to ensure transparency and fairness for borrowers. When it comes to foreclosure, RESPA sets strict guidelines to protect homeowners, especially those applying for loss mitigation—options like loan modifications, forbearance, or repayment plans to avoid losing their home.

Under RESPA, mortgage servicers must:

- Acknowledge your loss mitigation application promptly.

- Provide clear communication about your application status.

- Follow specific timelines before initiating foreclosure.

Key Takeaway: RESPA gives you rights to explore alternatives to foreclosure, but you need to act quickly and submit a complete loss mitigation application.

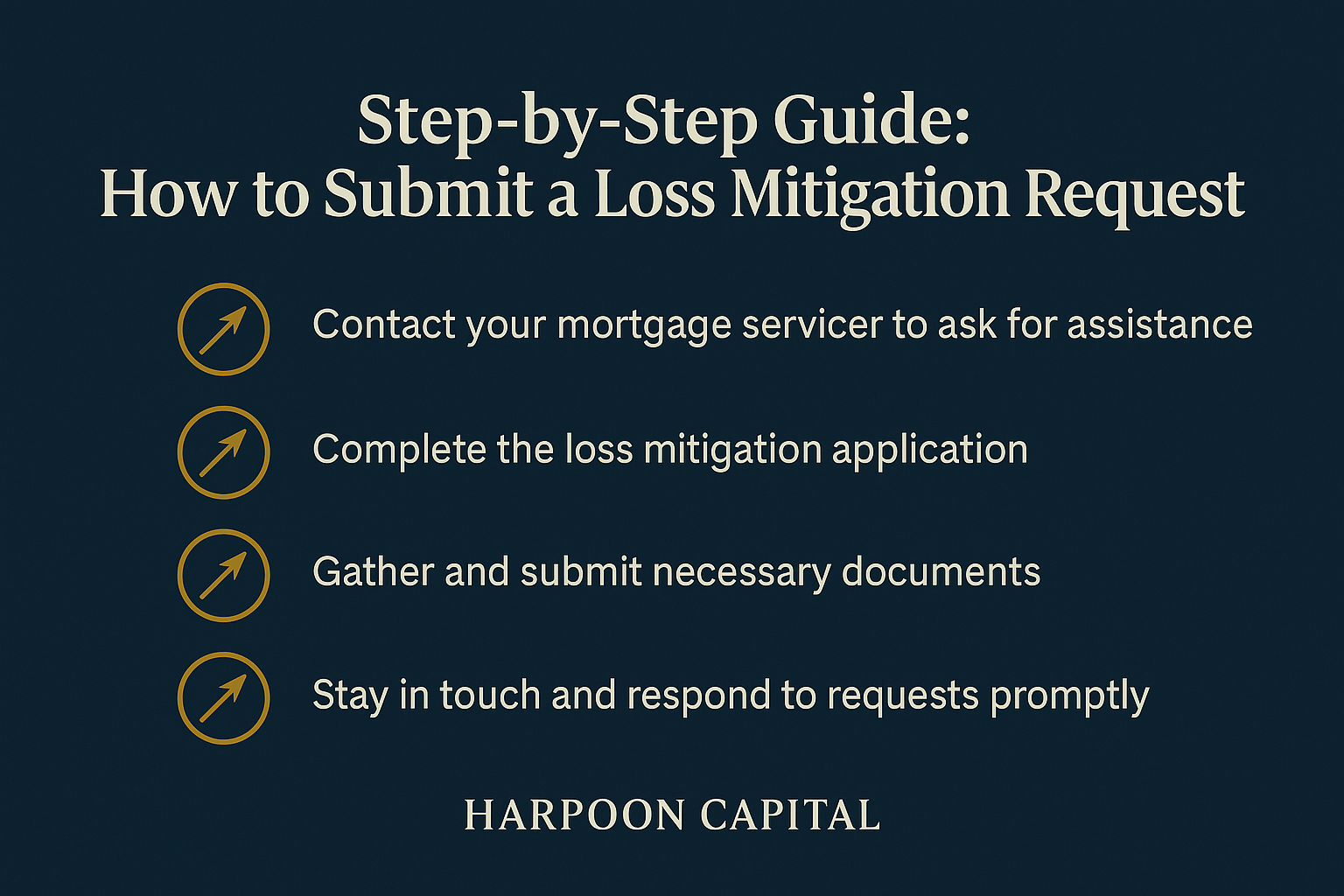

Step-by-Step Guide: How To Submit a Loss Mitigation Request

If you're struggling to make mortgage payments, submitting a loss mitigation application is a critical step to explore options with your lender.

If you're facing foreclosure, contact your loan servicer immediately. The earlier you act, the more options you have to keep your property.

Here’s how to do it under RESPA rules:

Step 1: Contact Your Mortgage Servicer

Reach out to your lender or mortgage servicer as soon as you anticipate payment issues. Ask for their loss mitigation application or check their website for forms.

Pro Tip: Document all communications—dates, names, and what was discussed—to create a paper trail.

Step 2: Complete the Loss Mitigation Application

Your application typically requires:

- Proof of income (pay stubs, tax returns).

- A hardship letter explaining why you can’t make payments.

- Recent bank statements and other financial documents.

Step 3: Submit the Application

Send your application via certified mail or through your servicer’s online portal to confirm receipt. Under RESPA, your lender must:

- Acknowledge receipt within 5 business days.

- Request any additional information needed to complete your application.

Step 4: Await Review and Stay Proactive

Once your application is complete, the servicer has 30days to evaluate it and offer loss mitigation options (e.g., loan modification, short sale). Stay in touch and respond promptly to any requests for more information.

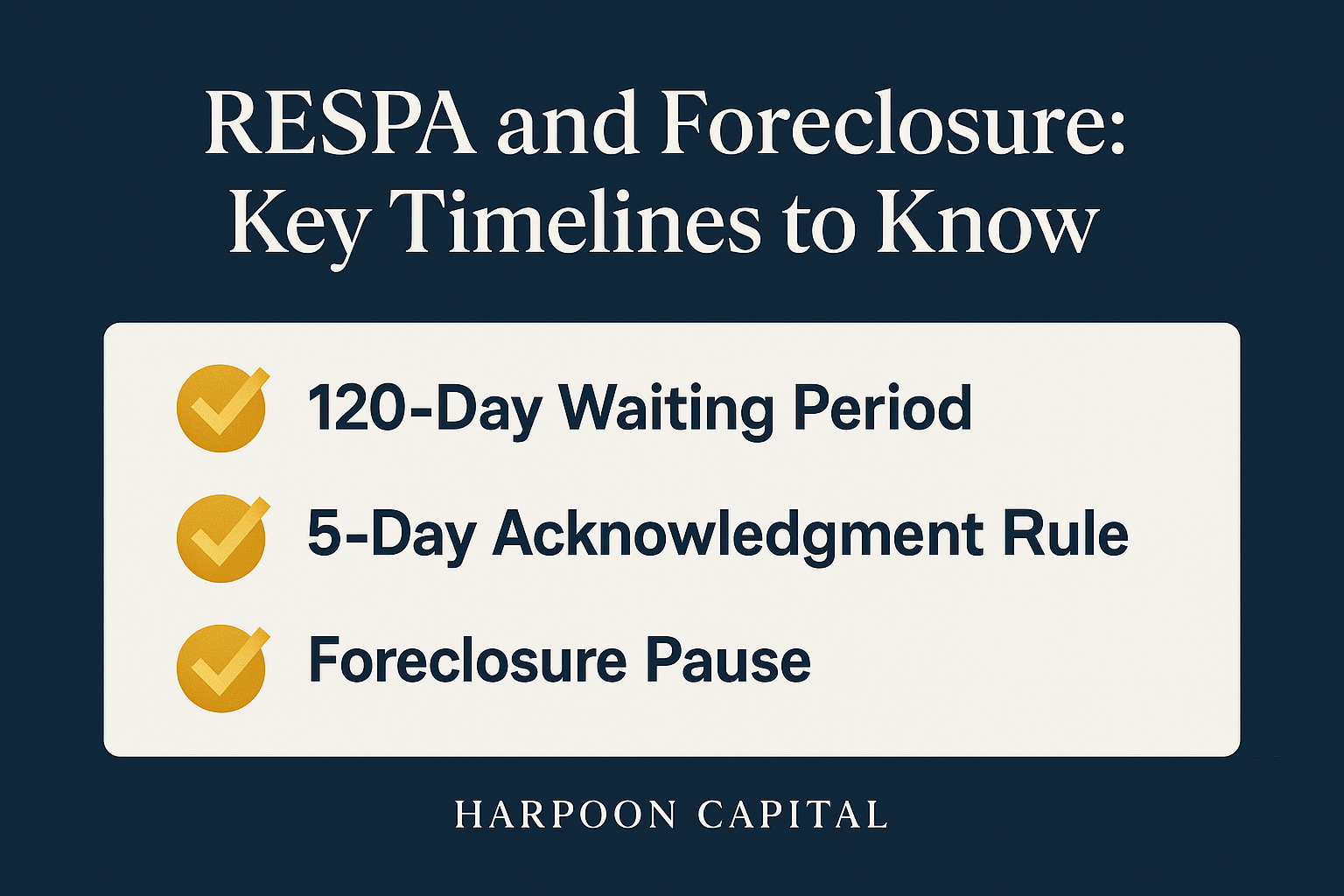

RESPA and Foreclosure: Key Timelines to Know

Understanding the foreclosure timeline under RESPA is crucial to protect your home. Here are the key rules:

- 120-Day Waiting Period: If you haven’t submitted a loss mitigation application, your mortgage servicer cannot start the foreclosure process (e.g., file a notice of default) until you’re 120 days delinquent on your mortgage. This gives you time to explore options.

- 5-Day Acknowledgment Rule: Once you submit a loss mitigation application, your lender must acknowledge receipt within 5 business days and inform you if any additional documents are needed.

- Foreclosure Pause: If you submit a complete loss mitigation application before the foreclosure process begins (or at least 37 days before a foreclosure sale), the servicer cannot start or continue foreclosure until they’ve reviewed your application.

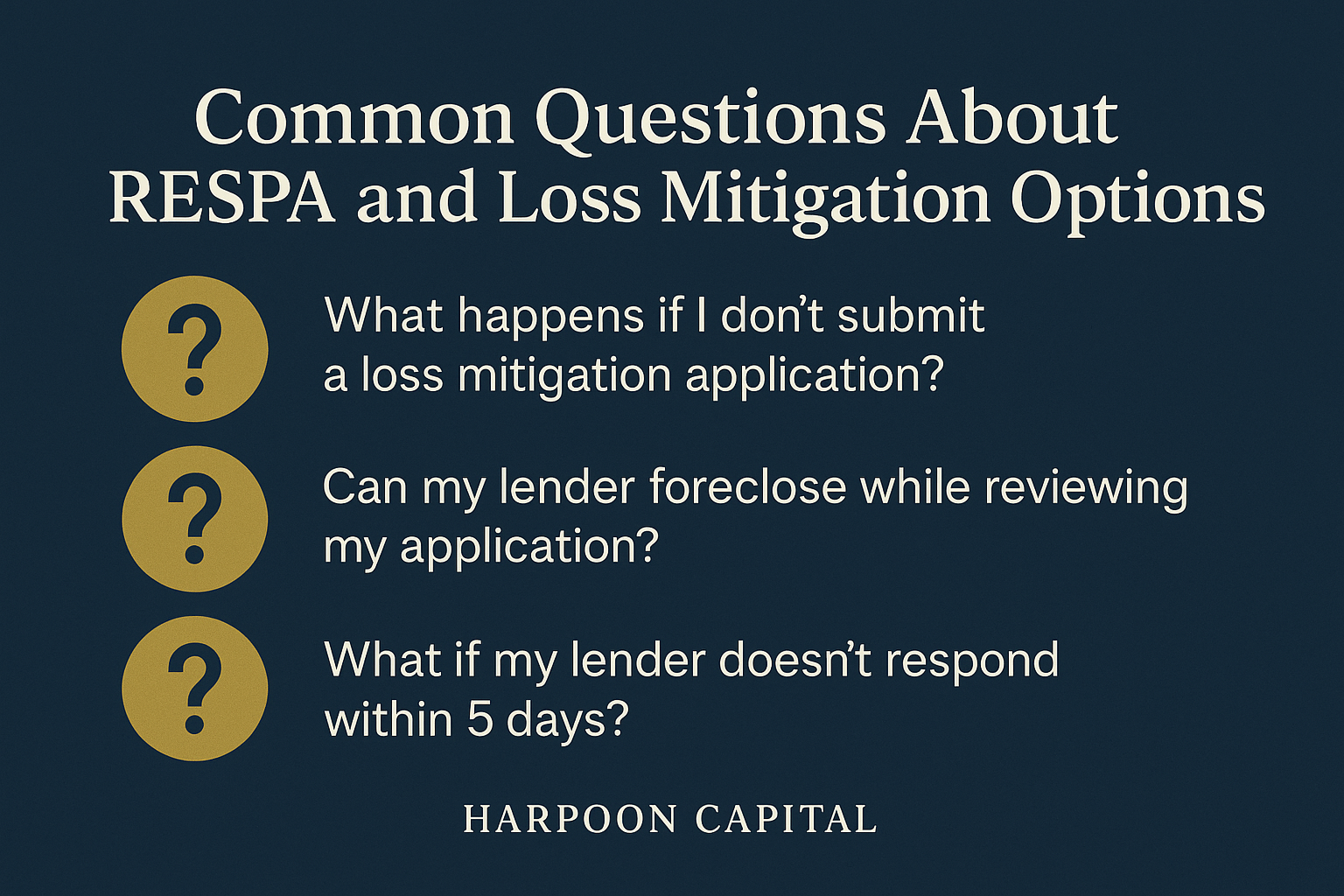

Common Questions About RESPA and Loss Mitigation Options

Q: What happens if I don’t submit a loss mitigation application?

A: Your servicer must wait 120 days after your first missed payment before starting foreclosure, but submitting an application gives you more options to save your home.

Q: Can my lender foreclose while reviewing my application?

A: No, if your application is complete and submitted early enough, RESPA prohibits foreclosure actions during the review process.

Q: What if my lender doesn’t respond within 5 days?

A: Contact them immediately and consider filing a complaint with the Consumer Financial Protection Bureau (CFPB)for non-compliance with RESPA.

Conclusion: If Facing Foreclosure, Know your Loss Mitigation Rights under RESPA

Submitting a loss mitigation request under RESPA rules is a powerful way to explore alternatives to foreclosure. By acting quickly, providing complete documentation, and understanding your rights, you can work with your mortgage lender to find a solution that keeps you in your home.

If you’re feeling stuck, don’t hesitate to contact your servicer or a housing counselor today. For more resources, visit the CFPB website or explore HUD’s homeowner assistance programs.