Proper property insurance is a critical requirement for DSCR Lenders. While the primary risk evaluated by DSCR Lenders is the risk of borrower default, i.e. failure to make payments of interest and principal on the loan, the biggest risk facing a DSCR Lender is different. In the case of default, the lender still has the opportunity (and likelihood) of being “made whole” or getting paid back through the foreclosure process; gaining ownership of the property and selling it for proceeds above what is due. The biggest actual risk for a DSCR Lender is that the property itself loses its value and is not available to be foreclosed upon in case of default. This can generally happen in two ways; either there is another party that has higher priority lien on the property (such as a governmental taxing authority or undisclosed lien holder) or that the property itself is destroyed or significantly damaged, and it is uninsured if this occurs.

If a property is destroyed or damaged and doesn’t have property insurance (where an insurer is required to provide cash payment in case of damage), then the DSCR Lender faces a catastrophic loss without the ability to foreclose on a property with a value near the loan amount due. Because of this risk, most DSCR Lenders require property insurance escrows (i.e. the borrower must have the servicer manage payment and insurance) and have strict and extensive documentation requirements around property insurance to make sure that the property (and its value) is fully insured and nothing is out of order in case a claim is needed.

Q: What property insurance documents are required for a DSCR Loan?

A: You will almost always need to provide both (1) Evidence of Insurance, such as a policy declaration page, insurance binder, or certificate and (2) a Property Insurance Invoice or Paid Receipt showing the premium is paid (or will be paid at closing). Without both, your DSCR Lender cannot clear the insurance condition to close.

Borrowers are generally expected to provide two distinct but related items for property insurance requirements. First is Evidence of Insurance, which is the documentation showing that the property is properly insured and includes needed coverages, coverage amounts and accurate ownership and lender information. Second is Evidence of Insurance Payment (Invoice), which includes the insurance amount and confirms either payment or that the insurance will be paid at loan closing (and feature on the settlement statement).

The Evidence of Insurance documentation requirement for DSCR Loans will typically include multiple acceptable forms of documentation. These can include:

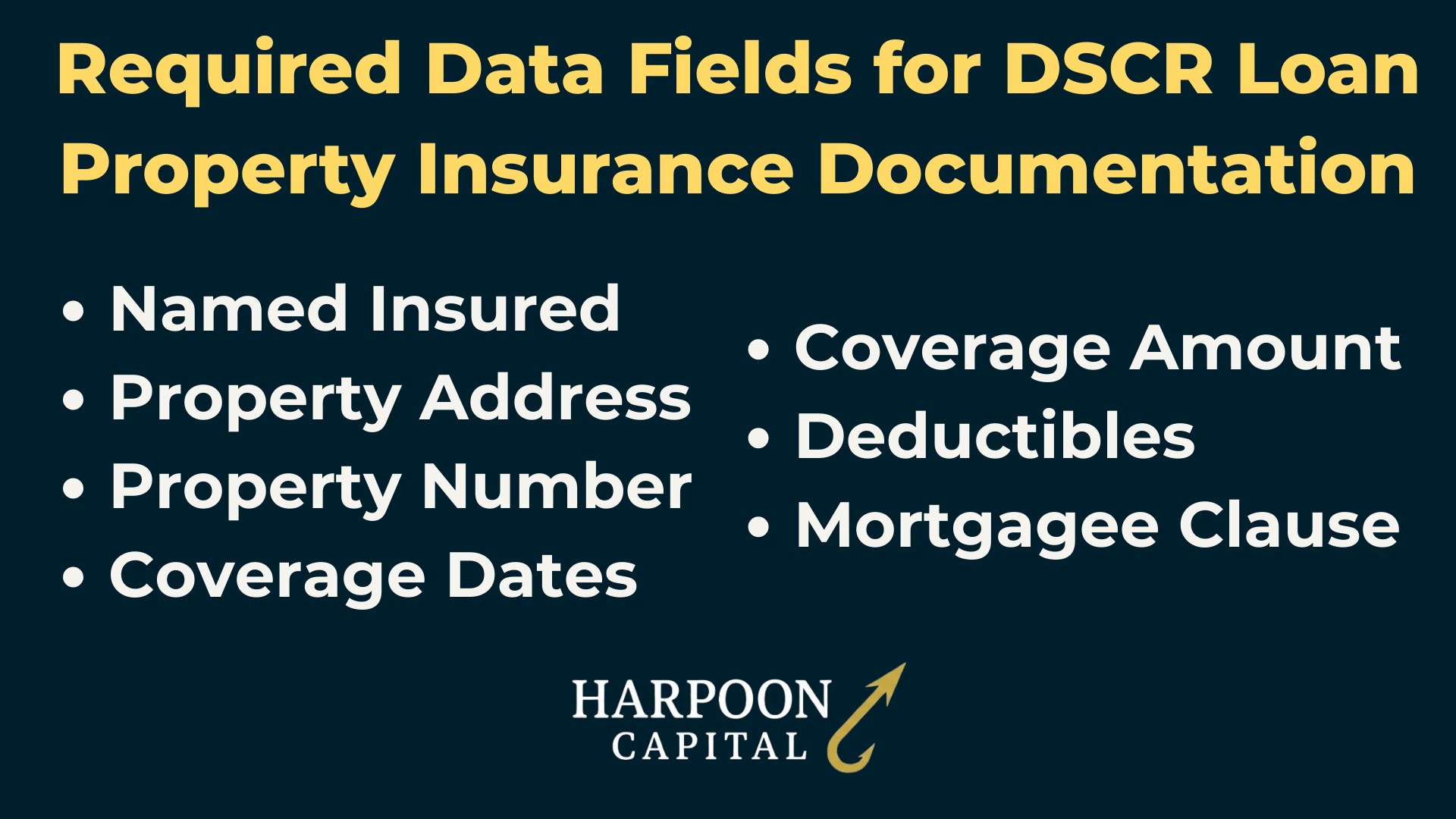

The key aspect of the Evidence of Insurance requirement for property insurance documentation on DSCR Loans is Required Data Fields must be on the documentation, whether utilizing a policy declaration page, evidence of insurance certificate or an insurance binder. These Property Insurance required data fields include:

Q: Do DSCR Lenders allow high deductibles on property insurance policies?

A: Generally, no. A deductible exceeding 5% of the coverage amount may be deemed unacceptable. Lower deductibles help ensure the borrower can afford repairs after a loss. While guidelines vary, 5% of coverage is a common industry ceiling for DSCR Loan property insurance requirements.

An important distinction is between the Proof of Insurance Documentation (such as the Policy Declaration Page, Evidence of Insurance Certificate and Insurance Binder) and the Proof of Insurance Payment documentation, which shows that the property insurance is live and paid for. Without this documentation of property insurance payment, the insurance documents are just proof of an insurance offer and quote, but without that, they are just that and not an actual policy in place if the insurance company doesn’t receive payment!

Q: Do DSCR Lenders require proof that property insurance has been paid before closing?

A: Not always before, but always by closing. The lender must verify the premium has been fully paid either before closing or at closing as part of the settlement. If the premium is paid at closing, it must appear on the settlement statement. Without confirmed payment for the full coverage term, the loan will not fund. A DSCR Lender will typically require either a Paid Receipt from the insurer or agent showing the policy is in force and paid in full or an Invoice indicating the premium will be collected at closing and documented on the final settlement statement.

How much property insurance coverage is needed for a DSCR Loan is another point of confusion for some investors. Since rental properties typically have a value based on a combination of the value of the property itself (called “improvements” in real estate technical lingo) and the land it sits on, the property insurance value needs to cover the value of the property (or “improvements”) only, and not the value of the land. This is logical, since in the case the property is destroyed, such as if it burns down in a fire for example, the land remains, and should still retain its value. The land would of course be in the same spot, i.e. neighborhood and market, it was before the property burned down. Thus, the property insurance provider is covering the cost to replace or rebuild the property to restore that part of the value, while the value of the land doesn’t need insurance coverage.

If your insurer suggests a policy underwritten to functional replacement cost, repair cost, or actual cash value, make sure that you have approval from your DSCR Lender as not all will accept these types of policies. They will usually be offered by insurers since they have lower premiums but they typically do not provide adequate coverage for replacing the improvement(s) to their original state.

Q: How much property insurance coverage is required for a DSCR loan?

A: Most DSCR Lenders require the policy to cover 100% of the property’s replacement cost, not its market value, or at least the loan amount if it’s 80% or more of replacement cost as determined by the property insurance provider.

The general rule of thumb for most all DSCR Lenders is requiring property coverage in the amount of 100% of the Property’s Replacement Cost or the Loan Amount (if equal to at least 80% of the Replacement Cost). These numbers are specifically derived from the basic need for the lender to be able to recoup the loan amount due in case of the property getting destroyed. If the insurance company will provide 100% of the costs to rebuild (i.e. replace the property), then the DSCR Lender has comfort that the full (i.e. 100%) value of the property will be restored and their same foreclosure rights will remain. If the insurance amount covers the loan amount only, and that includes up to 80% of the replacement value (typically lining up with the 80.0% LTV limit of most lenders), then the DSCR Lender has comfort that they will receive a payment from the insurance company of at least the loan amount due, also making them whole.

Many DSCR Lenders will require what is called a Replacement Cost Estimate (RCE) or equivalent documentation from the insurance provider to confirm the amount of coverage provided is sufficient to replace the property. There can be different state laws around property insurance disclosure requirements over whether a property insurance provider either must provide a formal RCE, may provide a formal RCE with borrower consent or even prohibited from providing an RCE.

Since these state-by-state laws and regulations can complicate DSCR Lender policies over RCE requirements (since a DSCR Lender that lends across the United States can’t require a document universally when some states prohibit the release of such document legally), it can be a point of confusion for DSCR Loans. Most states, such as Texas and Florida, don’t have a mandate to release it and the borrower (i.e. insured) must consent to its release to the lender. But because of the differing web of state laws and insurance company internal policies, RCE requests and requirements can become a sticking point for property insurance documentation for DSCR Loans. A best practice for borrowers is to research RCE rules for the state you are investing in early on, and confirm requirements and policies upfront with both your insurance provider and DSCR Lender to avoid any last-minute problems over this insurance aspect down the line. Additionally, make sure to ensure that the RCE coverage covers any recent renovations at the property, particularly when the renovations add square footage, as a common pitfall for DSCR Loans for recently renovated refinances (such as borrowers pursuing the BRRRR strategy) is an initial RCE policy that mistakenly uses square footage information from the pre-renovations. In these cases, the insurance policy coverage is likely to be rejected by the DSCR Lender, requiring a rework of the policy (adding unwanted time and stress to the deal).

Here is a quick example of how property insurance requirements may play out for a typical DSCR Loan. Consider the following values: the Purchase Price (Market Value) is $420,000 and the appraisal determines that this total value is made up of the value of the land of $110,000 and the value of the “improvements” (i.e. the home) of $310,000. The borrower is taking out an 80.0% LTV DSCR Loan (standard 20% down payment) with an Original Loan Amount of $336,000 The property insurance RCE determines a Replacement Cost of $305,000 (based on square footage, materials, and local construction costs). The required property insurance coverage is $305,000, as most DSCR Lenders will require coverage of the lesser of 100% of replacement cost ($305,000 in this example) or the loan amount, as long as it is 80% of the replacement cost ($336,000), in this case, since $305,000 is the lesser of the two numbers, it is the required amount. Note that the $420,000 total market value (and price the buyer/borrower is paying) is not required to be insured, since the additional $115,000 in market value comes from the land, which is unaffected by perils like fire, wind, or vandalism. If the property burned down, the insurance payout would cover rebuilding the $305,000 structure; the $110,000 land would still be intact and retain its value.

Here is an additional example of how property insurance requirements may play out for a DSCR Loan where the loan amount determines the coverage. Consider the following values: the Purchase Price (Market Value) is $510,000, and the appraisal determines that this total value is made up of a land value of $140,000 and improvements value (the building) of $370,000. The borrower is taking out a 75.0% LTV DSCR Loan (25% down payment) with an Original Loan Amount of $382,500.

The property’s Replacement Cost Estimator (RCE) calculates a Replacement Cost of $400,000 based on the home’s square footage, construction type, materials, and local labor costs. In this example, 100% of Replacement Cost = $400,000 and the Loan Amount = $382,500. Since the loan amount ($382,500) is less than 100% of the replacement cost but still exceeds 80% of it ($320,000), the DSCR Lender will require property insurance coverage equal to the full loan amount of $382,500. In the event of a total loss (e.g., fire or natural disaster), the insurance payout would fully protect the DSCR Lender’s collateral position by covering at least the outstanding principal balance, while the borrower’s land value of $140,000 remains unaffected and retains its intrinsic worth.

Some DSCR Lenders have explicit requirements for the financial strength or credit rating of your property insurance carrier. In those cases, the lender will typically require that your insurance provider meet minimum financial stability standards as measured by a nationally recognized rating agency because an insurance policy is only as strong as the company standing behind it. If the carrier becomes insolvent, there is a risk that claims will not be paid, and both the borrower and lender face potential catastrophic loss. Since the primary risk mitigant for DSCR Lenders is to foreclose on a property in case of default; ensuring that properties are always fully insured by an insurance company that can stay in business and fulfill any necessary claims is paramount.

Many DSCR Lenders will require standards for property insurance providers and these generally mirror Fannie Mae’s property insurance requirements for minimum carrier ratings and acceptability criteria. Those requirements typically accept ratings from four different rating providers and generally include any of the following:

In some cases, for state-licensed issuers, DSCR Lenders will only require being licensed and in good standing in the property’s state.

The Mortgagee Clause ensures that if the property suffers a covered loss, such as a fire or other catastrophe, insurance proceeds are directed in a way that protects the lender’s financial interest, not just the borrowers. Without it, an insurer could issue the claim check solely to the property owner, who could theoretically keep the funds without repairing or rebuilding, leaving the lender with only the ability to foreclose on the land or land with damaged property (i.e. a pile of rubble), likely worth well below the outstanding loan balance.

The Mortgagee Clause requires that the lender, as the holder of the first lien on the property, be named as a loss payee. In practice, this means claim proceeds are typically made payable jointly to the borrower and lender, or directly to the lender, ensuring that repairs are completed or loan balances reduced before any remaining funds are released to the borrower. This clause is a non-negotiable element of DSCR Loan insurance requirements and must match the lender’s required format exactly or else it will be sent back and made to be corrected – which can cause extra delays and headaches. This is because any little typo or error could cause the lender to potentially fail to achieve a claim in court if it comes to a potential major insurance claim – there’s a reason DSCR Lenders are such sticklers about this!

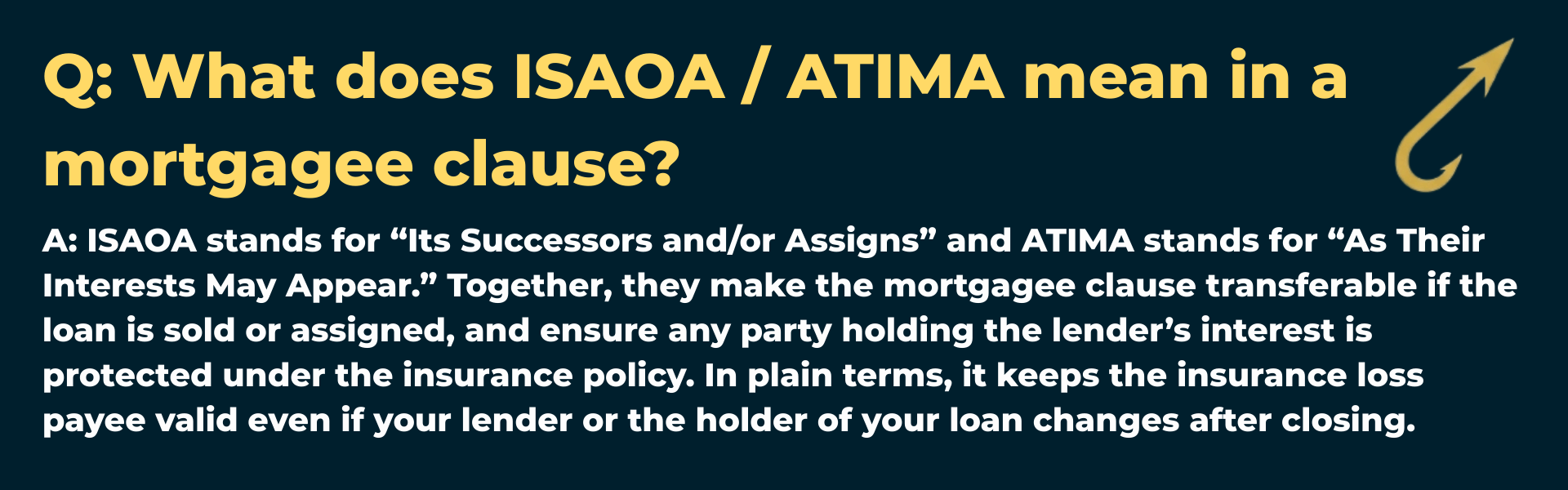

Q: What does ISAOA / ATIMA mean in a mortgagee clause?

A: ISAOA stands for “Its Successors and/or Assigns” and ATIMA stands for “As Their Interests May Appear.” Together, they make the mortgagee clause transferable if the loan is sold or assigned, and ensure any party holding the lender’s interest is protected under the insurance policy. In plain terms, it keeps the insurance loss payee valid even if your lender or the holder of your loan changes after closing.

Some DSCR Lenders require that a rental property’s insurance policy include Loss of Rents coverage (also called rent loss or business income – rental value coverage). This endorsement provides reimbursement for lost rental income if the property becomes uninhabitable due to a covered peril, such as fire, severe storm damage, or another insured event, during the time repairs are being made.

Because a property’s rental income is the intended source of covering PITIA payments for DSCR Loans, a sudden loss of that income can jeopardize the borrower’s ability to make mortgage payments. Loss of Rents coverage helps ensure there will still be funds available to keep the loan current until the property is restored in the case of catastrophic damage that restricts the property from being rented and generating cash flow for a significant period.

The typical requirements for Rent Loss Insurance for DSCR Loans (when applicable) is a coverage amount equal to the underwritten monthly rent (i.e. amount used in the numerator of the DSCR ratio calculation) multiplied by a coverage period, typically six to 12 months for rental loss coverage or ALS (“actual loss sustained”) for the coverage period/period of restoration (typically up to 12 months on business income policies). To fully document the rent loss insurance, coverage must be clearly shown on the policy’s declaration page or by a separate endorsement form. There will typically be a line item labeled Loss of Rents, Loss of Rental Value, or Business Income – Rental.

Although not all DSCR Lenders require Loss of Rents coverage, it’s probably required by around half of all active lenders in 2025. Some lenders may only require it when there are high-risk loan factors present, like low qualifying credit scores or if the DSCR ratio is thin (under or not much higher than 1.00x). Even when optional, real estate investors may want to consider adding it for added protection, particularly if reserves are limited.

Q: Do DSCR Lenders require Windstorm Insurance?

A: Generally, but only separate from the standard property insurance policy in instances when it is excluded from the hazard policy. Typically, windstorm coverage is fully included in the overall property insurance policy and not a separate documentation requirement.

Up Next: Learn about Flood Insurance Requirements for DSCR Loans and how to know if your property is going to require coverage.

© 2026 Harpoon Capital, LLC. All Rights Reserved. WARNING: Unauthorized distribution, copying, or sharing of this guide is a violation of U.S. Federal Law and is punishable by civil penalties of up to $150,000 per violation. We aggressively enforce our intellectual property rights.